In today’s dynamic investment landscape, traditional approaches to portfolio construction are evolving as investors seek more effective ways to achieve stable and enhanced returns. One asset class that has gained significant traction is private equity, which provides unique opportunities beyond the boundaries of public markets. For a detailed overview of private equity, its definition, structure, and place within an investment portfolio visit https://trueplatform.com/asset-class/private-equity. Incorporating private equity introduces new dimensions of diversification and can be a strategic move for those aiming to optimize their investments in a changing market. This increased interest is partly driven by structural shifts in the global economy, a growing appetite for alternative assets, and the search for superior performance in uncertain times.

The appeal of private equity lies in its ability to offer both institutional and individual investors access to a broader array of investment opportunities. By diversifying beyond public markets, private equity can play a crucial role in generating higher risk-adjusted returns, mitigating portfolio volatility, and exposing investors to emerging growth sectors. Moreover, private equity’s active management approach can drive operational improvements and growth in portfolio companies, unlocking value that is often out of reach for passive, public market-focused strategies. However, as with any investment, understanding the associated opportunities and risks is essential for making informed decisions in today’s complex financial environment.

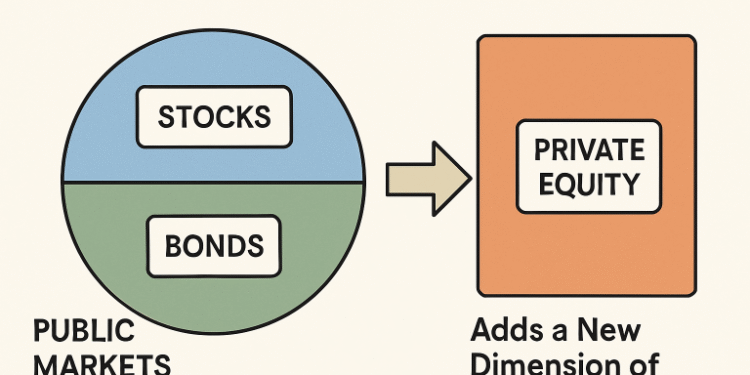

The traditional 60/40 portfolio an allocation strategy based on 60% equities and 40% bonds has served as a roadmap for balanced, long-term wealth creation for decades. Yet, persistent low yields and increased market volatility are prompting both institutional and retail investors to rethink this model. The rise in private equity’s prominence is a response to the limitations of public market-only investing, as it provides distinctive sources of return and diversification not available in traditional portfolios. In recent years, the increased frequency of economic shocks, global uncertainty, and the proliferation of new technologies have only heightened demand for investment solutions capable of weathering different market cycles.

More investors are recognizing that the search for outperformance and downside risk mitigation often means venturing into private markets, where innovative companies frequently realize much of their value before ever going public. Private equity, therefore, is becoming an essential building block for those looking to modernize their asset allocation approach and unlock new growth avenues. It enables investors to tap into industries and opportunities that are typically underrepresented or inaccessible in public markets, such as technology-led disruptors, middle-market companies, and direct real estate holdings.

Understanding Private Equity

Private equity refers to investment in companies that are not listed on public exchanges. Typically, private equity investors acquire significant ownership stakes to increase a company’s value over time through strategic guidance, operational improvements, and financial restructuring. These investments are generally made through private equity funds, which pool capital from multiple investors to acquire, manage, and eventually exit from a portfolio of private companies.

The private equity universe is diverse, comprising various strategies, including venture capital, growth equity, buyouts, and distressed investing. Venture capital focuses on early-stage companies with high growth potential, often in sectors like technology or healthcare. Growth equity invests in more established companies that are poised for expansion but require capital and expertise to scale. Buyout strategies involve acquiring majority control of mature companies, implementing operational efficiencies, and selling them for a profit. Distressed investing targets struggling businesses to turn them around and create value through restructuring. Each strategy offers a unique risk-return profile, timeline, and sector exposure, making private equity a versatile addition to most portfolios.

Benefits of Private Equity Inclusion

Incorporating private equity into a diversified investment portfolio can deliver numerous advantages. One of the most significant benefits is the potential for higher long-term returns. Historically, private equity has outperformed public equities over multi-year periods, benefiting from the ability to unlock value through active management and operational improvements. Private markets are less efficient than public ones, allowing skilled managers to exploit information asymmetries and drive superior results.

Another key benefit is diversification. Since private equity investments are typically not correlated with traditional assets, such as stocks and bonds, they can help reduce overall portfolio risk. This non-correlation is particularly valuable during periods of public market stress, as private equity valuations are less susceptible to daily market swings and are instead driven by fundamental business performance. Additionally, private equity can provide exposure to innovation and sectors that are often underrepresented in public markets, such as private technology firms, infrastructure, and specialty healthcare providers.

Challenges and Considerations

Despite its advantages, private equity investing comes with unique challenges and considerations. The illiquid nature of private equity means that investors must commit their capital for extended periods—sometimes up to 10 years or more—without the flexibility to sell their positions on a secondary market. This extended lock-up period necessitates careful liquidity planning and a willingness to accept less frequent performance reporting and valuation updates.

Additionally, private equity funds often require high minimum investments and can be accompanied by complex fee structures, making them less accessible to some investors. As a result, conducting proper due diligence on fund managers, investment strategies, and portfolio companies is critical. The performance of private equity is highly dependent on the expertise of the fund managers, whose ability to identify, acquire, improve, and exit companies directly impacts overall returns. Investors should be prepared to assess track records, alignment of interests, and transparency regarding fund operations and fees.

Strategies for Integrating Private Equity

Successfully integrating private equity into a portfolio starts with a clear understanding of one’s investment goals, risk tolerance, and time horizon. For some, private equity may represent a small allocation aimed at enhancing growth potential, while for others, it might serve as a foundational component of a broader alternatives strategy. Approaches can range from direct investment in private companies and co-investments alongside established fund managers to participating in pooled private equity funds that diversify across sectors and geographies.

For investors new to private equity, gaining initial exposure through feeder funds or funds-of-funds can lower barriers to entry by reducing minimum investment sizes and diversifying risk across multiple managers and deals. More sophisticated investors may target sector-specific or geographically focused funds to tailor exposures according to their portfolio objectives. Regardless of the approach, ongoing monitoring and rebalancing are crucial for managing liquidity, maintaining target allocations, and adapting to market changes over time.

Conclusion

Private equity is a powerful tool for those seeking to enhance portfolio diversification and pursue higher long-term returns in a rapidly evolving investment landscape. Its ability to access unique, non-public opportunities and add value through active management makes it an increasingly important consideration for modern investors. However, careful assessment of the challenges, including illiquidity, fees, and manager selection, is essential to successful integration. By taking a deliberate, informed approach, investors can position themselves to benefit from private equity’s distinctive characteristics while managing risks and building resilient, future-ready portfolios.