The Limited Liability Company (LLC) has become a favored business structure for entrepreneurs and established corporations alike. Combining the liability protection of a corporation with the tax benefits and operational flexibility of a partnership, LLCs offer a versatile framework for businesses of all sizes.

This article delves into the world of famous LLCs, exploring how top companies have leveraged this structure to achieve remarkable success.

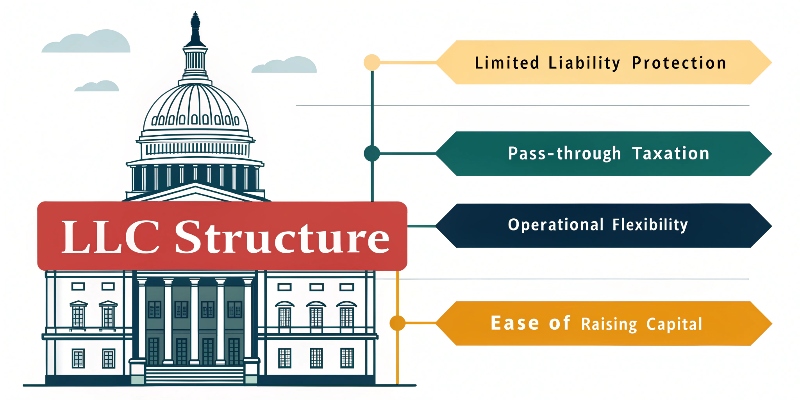

Understanding the LLC Structure

An LLC is a hybrid business entity that provides its owners, known as members, with limited liability protection. This means that members are typically not personally responsible for the company’s debts or liabilities. Additionally, LLCs offer pass-through taxation, where profits and losses are reported on the members’ personal tax returns, avoiding the double taxation commonly associated with corporations. The flexibility in management and fewer compliance requirements make LLCs an attractive option for many businesses.

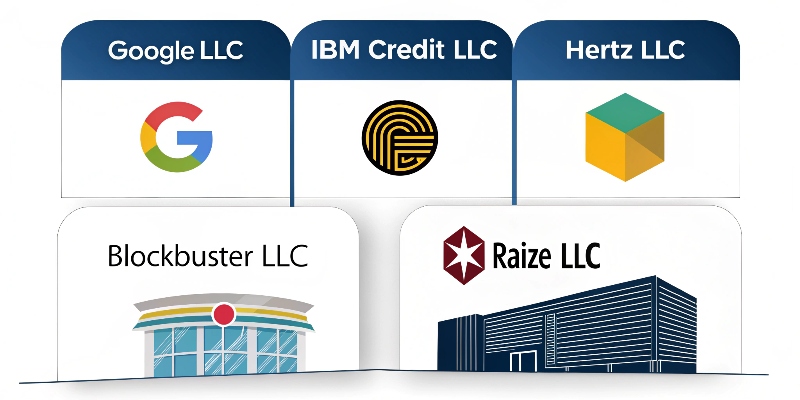

Notable Companies Operating as LLCs

1. Google LLC

Founded in 1998 by Larry Page and Sergey Brin, Google began as a research project and quickly evolved into the world’s leading search engine. Operating as Google LLC, the company has expanded its services to include email, cloud storage, advertising platforms, and more. The LLC structure has provided Google with the flexibility to innovate rapidly while maintaining a level of liability protection.

2. IBM Credit LLC

IBM Credit LLC is a subsidiary of IBM that offers financing solutions to clients purchasing IBM products and services. By operating as an LLC, IBM Credit can manage financial risks effectively while providing tailored financing options to its customers. This structure supports IBM’s broader strategy of offering comprehensive solutions beyond hardware and software.

3. Hertz Vehicles LLC

Hertz, a globally recognized car rental company, operates through various subsidiaries, including Hertz Vehicles LLC. This LLC structure allows Hertz to manage its vast fleet and rental operations efficiently, isolating liabilities and streamlining management across different regions and services.

4. Blockbuster LLC

Once a dominant force in the home video rental industry, Blockbuster operated as Blockbuster LLC. While the company eventually declined due to the rise of digital streaming, its LLC structure provided a framework for managing its extensive network of stores and franchises during its peak years.

5. RAIZE LLC

RAIZE is a modern bakery that has reimagined traditional baked goods to cater to contemporary tastes and dietary preferences. Operating as RAIZE LLC, the company benefits from the LLC structure’s flexibility, allowing it to innovate in product development and adapt quickly to market trends.

Advantages of the LLC Structure for Large Companies

Flexibility in Management

LLCs offer a flexible management structure, allowing companies to choose between member-managed or manager-managed setups. This flexibility enables businesses to tailor their governance to best fit their operational needs and strategic goals.

Liability Protection

One of the primary benefits of an LLC is the limited liability protection it offers. Members are generally not personally responsible for business debts and liabilities, which is crucial for large companies managing significant assets and operations.

Tax Benefits

LLCs benefit from pass-through taxation, where profits and losses are reported on the members’ personal tax returns. This can result in tax savings and simplifies the tax filing process compared to traditional corporations.

Operational Efficiency

With fewer compliance requirements and formalities than corporations, LLCs can operate more efficiently. This efficiency allows large companies to focus on growth and innovation rather than administrative burdens.

The Global Appeal of LLCs

While the LLC is a U.S.-specific business structure, its principles have influenced business entities worldwide. Many countries have adopted similar structures that offer limited liability and operational flexibility, recognizing the benefits that LLCs provide to businesses of all sizes.

Conclusion

The LLC structure has proven to be a powerful tool for companies aiming to combine liability protection with operational flexibility. From tech giants like Google to innovative startups like RAIZE, businesses across various industries have leveraged the advantages of LLCs to drive success. As the business landscape continues to evolve, the LLC remains a compelling choice for companies seeking a balanced and adaptable organizational structure.

FAQS

1. Why do large companies like Google operate as an LLC?

Large companies like Google benefit from the flexibility and legal protection an LLC provides. It helps separate personal assets from business risks while simplifying internal management. LLCs also allow for pass-through taxation, which can reduce tax burdens. For tech giants, it supports innovation without the hassle of rigid corporate rules.

2. Can an LLC become a large global brand?

Yes, many global brands started as or transitioned into LLCs as they scaled. The LLC structure is not just for small businesses—it supports growth, partnerships, and expansion. It also allows the brand to stay agile while enjoying legal protections. Well-known companies like Blockbuster and Google LLC are proof of that.

3. What happens when a famous LLC shuts down, like Blockbuster?

When an LLC shuts down, it must go through a formal dissolution process according to state laws. Assets are liquidated, debts paid, and the business is legally closed. The LLC structure ensures members aren’t personally liable for most remaining debts. This protects the owners’ personal assets from business failure.

4. Why do tech companies prefer LLCs over corporations?

Tech startups often prefer LLCs for their simplicity and flexible structure. An LLC allows easy profit sharing, less rigid management, and fewer formalities. It also attracts investors through member-managed agreements. With fewer restrictions, innovation and rapid scaling become more achievable.

5. Is it common for big brands to have multiple LLCs under one parent company?

Yes, many large businesses form multiple LLCs to separate operations, assets, and liabilities. This strategy isolates legal risk and simplifies tax reporting. For example, Hertz Vehicles LLC operates under The Hertz Corporation. It’s a smart move to protect different parts of the business.

6. Can an LLC become a publicly traded company?

An LLC cannot be publicly traded in its current structure. If an LLC wants to go public, it must convert into a corporation. This process is called an “entity conversion” and involves legal and tax steps. Public markets require the stricter compliance that corporations offer.

7. How does an LLC help with financial flexibility?

LLCs allow businesses to manage income and losses more efficiently through pass-through taxation. This gives members the option to avoid corporate tax rates and report profits on personal returns. It also enables easier reinvestment in the business. These features support smoother cash flow and long-term growth.

8. Do famous LLCs still need operating agreements?

Yes, even the biggest LLCs are advised to maintain detailed operating agreements. These documents define management roles, profit distribution, and dispute resolution. A solid agreement keeps everything smooth, especially with multiple owners. It’s a vital document regardless of the company’s size.

9. Why do some celebrities use LLCs for their brands?

Celebrities often form LLCs to manage their income, business ventures, and brand deals. The LLC protects personal assets and allows easy separation of professional and personal finances. Stars like Rihanna and Beyoncé have used LLCs for beauty lines and ventures. It’s smart, secure, and financially strategic.

10. Are there any disadvantages for big companies using LLCs?

Yes, despite many benefits, LLCs also have some drawbacks. They may face limited access to venture capital or public funding. In some states, LLCs have higher fees and taxes than corporations. And certain investor types prefer corporate shares over LLC membership interests. However, for many, the pros outweigh the cons.